NYS Emergency Rental Assistance Program (ERAP)

Met Council is no longer providing ERAP application assistance as of September 30, 2022.

New York state ERAP applications will no longer be accepted after 9pm on January 20, 2023. You will no longer be able to submit or complete a new application after this time.

Applications submitted prior to this closing will continue to be processed in the order reviewed, following state law and program requirements.

To be notified of future opportunities to apply for the ERAP program, you can complete the NY State Emergency Rental Assistance Program – Notify Me Form:

New York State Emergency Rental Assistance Program – Notify Me Form.

For additional questions, you can call the OTDA Call Center for assistance at 1-844-NY1-RENT (1–844-691-7368)

While an application is being processed, evictions proceedings cannot move forward. A legal proceeding must be brought against you to remove you from your home.

In New York City, you have the right to an attorney in housing court.

If you need an attorney or legal advice?

• HOUSING COURT ANSWERS: (212) 962-4795

• NYLAG [New York Legal Assistance Group]: (212) 613-5000

• THE LEGAL AID SOCIETY: (718) 645-3111

WHO CAN HELP WITH MY RENTAL ARREARS AFTER ERAP?

Met Council is still here to help with other needs and when you still have rental arrears after ERAP pays! Please contact our Crisis Call Center at 929-292-9261 or via email at [email protected]

ONE SHOT DEAL: You can apply online through Access HRA or in person at a local job center for this program for assistance towards your rental arrears.

*Eligibility criteria for the One Shot Deal is different than ERAP eligibility criteria.

• Access HRA NYC Online Application here.

• Homebase agencies located throughout NYC can also help eligible households apply for other housing and rental assistance programs.

• You must go to the Homebase agency that covers your zip code.

• You can find your location in Brooklyn by going here.

ERAP OVERVIEW

Benefits:

Households approved for ERAP may receive:

-

Up to 12 months of rental arrears payments for rents accrued on or after March 13, 2020.

-

Up to 3 months of additional rental assistance if the household is expected to spend 30 percent or more of their gross monthly income to pay for rent.

-

Up to 12 months of electric or gas utility arrears payments for arrears that have accrued on or after March 13, 2020. (A household must be eligible for rental arrears payments in order to apply for utility arrears payments as well. A household cannot only apply for utility arrears).

Payments will be made directly to the landlord/property owner and utility company on behalf of the tenant. Property owners may initiate an ERAP application on behalf of tenants who are otherwise eligible for ERAP. Tenant applicants will be notified of the amounts paid on their behalf.

Eligibility Criteria:

New York residents may be eligible for ERAP if they meet all of the following criteria:

-

They fell behind in rent since the COVID-19 pandemic began on or after March 13, 2020; AND

-

They qualified for unemployment benefits OR have lost income and/or have an increase in expenses due to the COVID-19 pandemic; AND

-

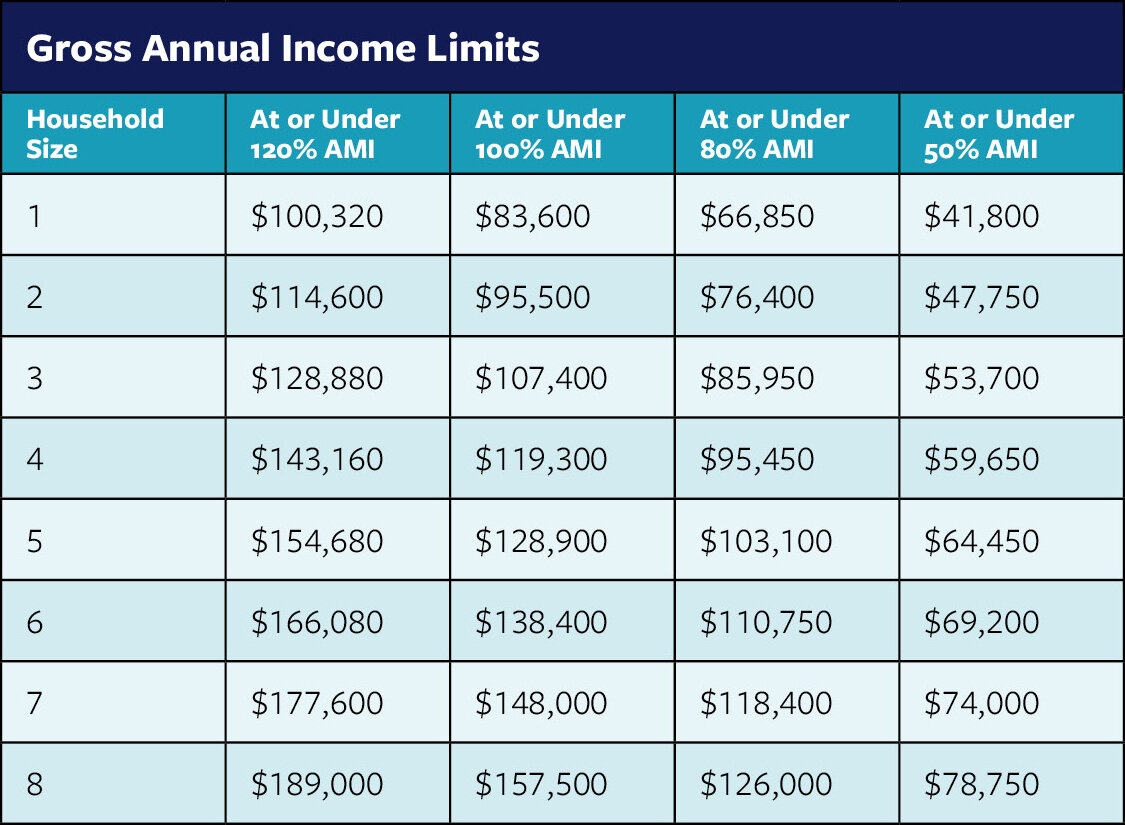

They have a monthly gross (before tax) household income at or below 80% of Area Median Income (AMI) or $85,950 for a family of three.

-

A household may qualify based on current income or calendar year 2020 income that is at or below 80 percent AMI.

-

Households eligible for rental arrears may also be eligible for help paying utility arrears at the same rental unit.

Starting September 15, 2021, households with gross income between 80 and 120 percent AMI will be accepted through the ERAP application portal. These income limits differ by county and household size. A household may qualify based on current income or calendar year 2020 income that is at or below 120 percent AMI. Households with income between 80 and 120 percent AMI are eligible for a state-funded ERAP payment so long as funds remain available. Applications from households with income up to 100 percent AMI will be prioritized for processing through October 29, 2021. After that, all applications for households with income up to 120 percent AMI will be processed on a first-come, first-served basis.

Recent legislation created another new program to provide rental assistance for landlords whose tenants have left their rental property or who are unwilling to apply for ERAP. Additional details regarding this program are available here. As of November 21, 2021 at 5 pm, new LRAP applications are no longer accepted. Property owners who already submitted a complete application may still access their account and upload any required documentation.

You can find additional information and Frequently Asked Questions on the NYS OTDA website.

If you need additional assistance, you can call the NYS OTDA Call Center seven days a week from 8:00 am – 7:00 pm at 1-844-NY1-RENT (1-844-691-7368). You can also chat with an agent live here.

Appeals:

If a tenant or landlord/owner disagrees with all or part of their ERAP application determination, they can file an appeal by phone or online.

-

By phone: 844-NY1RENT (844-691-7368) or TTY 1-833-843-8829

-

Online: Complete the Rental Assistance Program Appeal Form.

-

For instructions on how to fill out the appeal form read the ERAP Appeal Form Instructions.

-

After filing their appeal, the applicant will get a written Confirmation Notice from OTDA via email or regular mail, confirming that their appeal was received and that if they choose to provide additional documentation to support their appeal, they must do so within ten days. Instructions on how to add documentation to an appeal are available here.

For additional support submitting an appeal, applicants can contact OTDA by phone at 844- NY1RENT (844-691-7368) or TTY 1-833-843-8829, or contact a Community-Based Organization that is providing ERAP support to tenants and landlords.

Priority Applications

During the first 30 days of the program, New York State is prioritizing households with income at or below 50% AMI or $43,700 for a family of three AND at least one household member within the following categories:

-

Currently unemployed for at least 90 days;

-

Veteran;

-

Experiencing domestic violence or is a survivor of human trafficking;

-

Has an eviction case related to their current residence pending in court;

-

Lives in a community that was disproportionately impacted by COVID-19;

-

Lives in a dwelling of 20 or fewer units; or

-

Lives in a mobile home.

After the first 30 days, applications for all eligible households will be reviewed on a first-come, first-served basis. Funds are limited so all eligible households should apply as soon as possible regardless of whether they are in a priority group.

ARE YOU A TENANT?

Renter Applicants

Renters will need to provide:

-

Personal identification for all household members. Acceptable forms of identification include: A photo ID, driver license or non-driver government-issued ID, passport, EBT/Benefits Issuance Card, birth or baptismal certificate, school registration.

-

Social Security number of any household members who have been issued one. Individuals do not need to have a lawful immigration status to qualify for the program.

-

Proof of rental amount, signed lease, even if expired. If no lease is available then proof can be shown through a rent receipt, canceled check or money order. If no documentation is available, landlord attestation will be accepted.

-

Proof of residency and occupancy – Signed lease, rent receipt, utility bill, school records, bank statement, postal mail with name of applicant, insurance bill, or driver license. Proof should be current.

-

Proof of Income to document income eligibility:

-

Documents demonstrating monthly income for the prior month, such as pay stubs, bank account deposit verification, unemployment benefits letter, or other proof;

OR -

Documents demonstrating annual income for 2020, such as a W-2 tax form from an employer, an annual statement of earnings, or a copy of a completed income tax return, such as a 1040, 1040EZ, 1099 tax form, or other evidence of 2020 annual income.

-

Self-attestation of income is permitted in certain circumstances where no documentation is available such as certain self-employment.

-

-

Copy of gas or electric utility bill, if applying for help paying for utility arrears at the same rental unit.

Applicants will be asked to attest that on or after March 13, 2020, a member of the household received unemployment benefits or experienced a reduction in household income, incurred significant costs or experienced other financial hardship, directly or indirectly, due to the COVID-19 pandemic. The applicant will need to sign the application form and associated certifications agreeing that the information provided in the application is accurate. The applicant can sign electronically.

You can find the Renter Checklist here.

ARE YOU A LANDLORD?

Landlord Applicants

Landlords and property owners will need to provide:

-

Completed W-9 tax form.

-

Executed lease with tenant applicant, or if there is no written lease, a cancelled check, evidence of funds transfer or other documentation of the last full monthly rent payment.

-

Documentation of rent due from tenant (e.g. ledger, etc.) or attestation on application.

-

Banking information to receive direct deposit payment.

The property owner or an authorized property management company will be required to sign the application form and associated certifications agreeing that the information provided, including the amount of rental arrears owed, is accurate and does not duplicate a payment received from another program.

The property owner or authorized property management company must also agree to the following terms as a condition of accepting rental arrears payments:

-

The ERAP payment satisfies the tenant’s full rental obligations for the time period covered by the payment.

-

Waive any late fees due on any rental arrears covered by the ERAP payment.

-

Not increase the monthly rental amount above the monthly amount due at the time of application for ERAP assistance for months for which rental assistance is received and for one year from receipt of the ERAP payment.

-

Not evict the household on behalf of whom the ERAP payment is made for reason of expired lease or holdover tenancy for one year from the receipt of the ERAP payment. An exception to this requirement shall be made if the dwelling unit contains four or fewer units and the property owner or owner’s immediate family members intend to immediately occupy the unit for use as a primary residence.

You can find the Landlord Checklist here.

Recent legislation created another new program to provide rental assistance for landlords whose tenants have left their rental property or who are unwilling to apply for ERAP. Additional details regarding this program, including an opening date and documentation requirements, will be posted on the OTDA website as they become available.

ADDITIONAL ERAP ENROLLER ORGANIZATIONS BY BOROUGH

The community-based organizations listed below can also help you apply for ERAP.

Brooklyn

Queens

Bronx

Manhattan

Staten Island